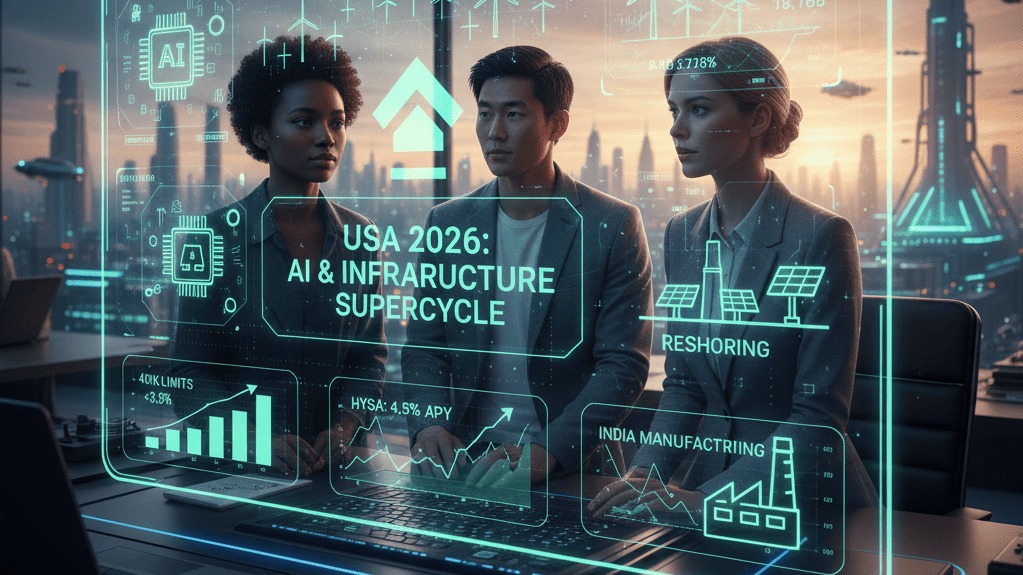

In 2026, the American financial landscape has matured into a fascinating "post-volatility" era. While the early 2020s were defined by pandemic recovery and high inflation, 2026 is the year of The Infrastructure Supercycle—driven by the massive energy needs of AI and the "reshoring" of American manufacturing.

Whether you are a Gen Z professional starting your first job or a late-bloomer looking to catch up, here is the updated blueprint for investing in the USA in 2026.

1. The 2026 Macro Environment: What’s Different?

Before picking stocks, you must understand the current economic climate:

- Sticky Inflation & Rates: Inflation has stabilized around 3%, and the Federal Reserve’s terminal rate is hovering near 3.25%. This means "cash is no longer trash"—High-Yield Savings Accounts (HYSAs) and CDs are finally offering respectable returns.

- The Energy Crisis: AI data centers are now the most electricity-hungry entities in history. In 2026, the smart money is moving away from just "software" and toward the "hardware and power" that keeps AI alive.

- Tariff Impacts: With increased focus on "America First" trade policies, domestic manufacturers (Industrials) are seeing a resurgence as supply chains move back to the U.S.

2. Maximize Your 2026 Tax Shelters

The IRS has updated contribution limits for 2026. If you don't use these, you are essentially giving away free money to the government.

Pro Tip: If you earn over $150,000, remember that under SECURE 2.0, your 401(k) catch-up contributions (if you're 50+) must now be made into a Roth (after-tax) account.

3. Choosing Your 2026 Investment Platform

In 2026, brokerage apps have evolved beyond simple trades into full financial ecosystems.

- Fidelity & Schwab: Best for those who want deep research, human support, and "fractional shares" (the ability to buy $5 worth of a $500 stock).

- SoFi & Robinhood: Best for mobile-first users who want a clean interface and the ability to manage checking, savings, and stocks in one app.

- Interactive Brokers (IBKR): Best if you want to trade international stocks or use advanced AI-driven portfolio tools.

4. Building the "Resilient Core" Portfolio

In 2026, a "balanced" portfolio looks a little different than the old 60/40 (stocks/bonds) split. Consider a Core-and-Satellite approach:

The Core (70-80%): Low-Cost Index Funds

- Total US Market (VTI or VOO): Captures the growth of the top 500+ US companies.

- Total International (VXUS): Gives you exposure to emerging tech hubs in India and Southeast Asia.

The Satellites (20-30%): 2026 Megatrends

- AI Infrastructure: Focus on Semis, Data Center REITs, and Power Grid Utilities.

- Domestic Industrials: Companies involved in U.S. factory construction and LNG (Liquefied Natural Gas) exports.

- Healthcare Innovations: GLP-1 (weight-loss) drug leaders and AI-driven biotech.

5. The Step-by-Step Launch Plan

Step 1: The "Financial First Aid Kit"

Do not invest money you need for rent. Build an emergency fund of 3-6 months in a High-Yield Savings Account earning at least 4.5%.

Step 2: Secure the Match

If your employer offers a 401(k) match, contribute enough to get it. It’s a 100% return on your investment before the market even moves.

Step 3: Open a Roth IRA

If you fall under the income limits ($153,000 for singles in 2026), open a Roth IRA. This is where you put your highest-growth "satellite" stocks so you never pay taxes on the gains.

Step 4: Automate the "Step-Up SIP"

Set up an automatic transfer from your bank. In 2026, the best strategy is the Step-Up SIP: start with an amount you can afford, and program the app to increase that amount by 1% every month. You won't notice the difference in your lifestyle, but your future self will.

6. Managing the Psychological Risks

2026 is a year of "loud headlines." AI will be changing jobs, and political cycles will create market noise.

- Ignore the "Meme" Bots: In 2026, AI-generated social media bots frequently "pump" stocks. Always verify through SEC filings or trusted brokers like Fidelity.

- The 24-Hour Rule: If you see a scary news headline, wait 24 hours before making any changes to your portfolio. Most market "crashes" in the 2020s have been short-term blips.